revolving open end credit example

For example you may borrow 20000 for 60 months to buy a car. Open-end credit also called revolving credit can be defined as a line of credit that gives the borrower a certain limit of credit and the ability to frequently borrow as little or as much of that money and repay any amount utilized below the set limit within a specified period.

Chapter Open Ended Credit An Agreement To Lend The Borrower An Amount Up To A Stated Limit And To Allow Borrowing Up To That Limit Again Whenever Ppt Download

C If the balance is not paid off over a period of months a penalty is incurred.

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

. Revolving open-end credit typically does not specify a maximum amount that can be borrowed. A Credit cards are an example of it. Credit cards are the most popular example of revolving credit and Americans are awash in debt because of them.

Credit cards and home equity lines of credit HELOCs on the other hand are open-end or revolving credits. Ad Apply With Confidence. The credit account can be used repeatedly provided your account stays open and all minimum payments are met.

Compare Your Capital One Card Options Today. One of the reasons why an open-end credit is preferred is that it makes money available to borrowers if and when it is needed. How Open-End Credit Works.

Examples of an Open-End Loan. Borrowers can use it as much or as little as they want as long as the account is open they make the monthly payments and. With open-end or revolving credit loans are made on a continuous basis as you purchase items and you are billed periodically to make at least partial payment.

Which of the following is not true regarding revolving open-end credit. Generally it is uneconomical and expensive for a borrower to borrow money repeatedly every two or three months and repay it fully. A credit card is a common example of revolving credit.

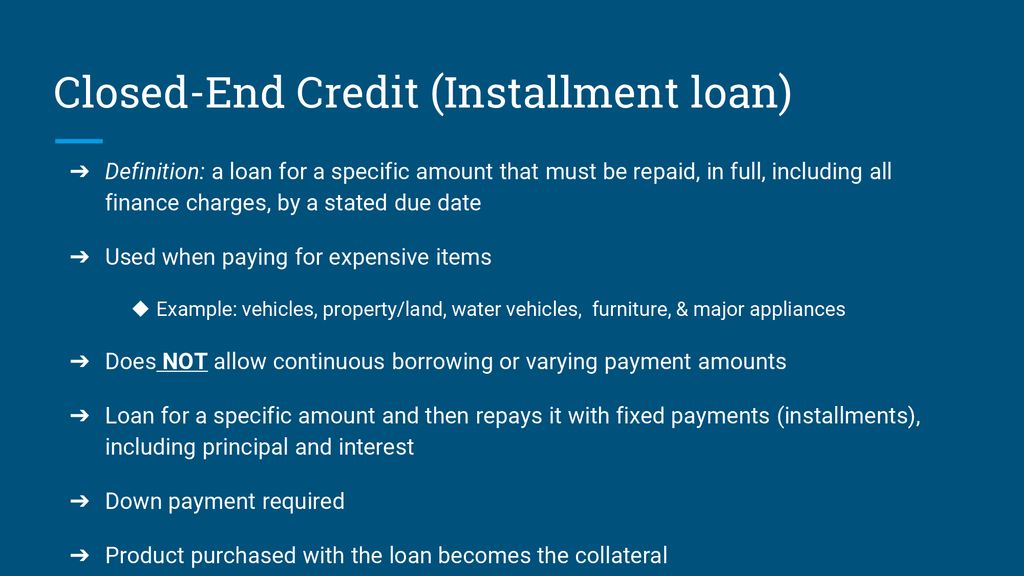

An example of this would be a cellphone bill you can make phone calls send. By contrast a revolving credit facility refers to a line of credit between your business and the bank. Installment credit gives borrowers a lump sum and fixed scheduled payments are made until the loan is paid in full.

Here well look at the definition of the closed end credit with some examples. Open-end loans can also take the form of credit cards or home equity lines of credit. To understand it better a line of credit as used in the.

Revolving credit is a loan with a predetermined spending limit that automatically renews as the debt is paid off. The most common example of this is a credit card. Examples A credit card with revolving credit.

But you are required to pay the funds borrowed in full at the end of each period. Credit enables people to purchase goods or services using borrowed money. Open End Credit This is a type of credit loan paid on installments in which the total amount borrowed may.

A revolving line of credit is a preapproved loan or credit line that lets consumers and businesses borrow and repay money on a regular basis. Using a credit card issued by a store a bank card such as VISA or MasterCard or overdraft protection are examples of open-end credit. B A specific maximum amount of credit is established.

A common type of open-end loan is a line of credit. In order to have good credit in the future you must have used it wisely in the past. See Cards Youre Pre-Approved for Before Starting Your Application.

With open-end loans borrowers can spend money up to a. An example of revolving credit is the home equity line of credit. It comes with an annual percentage rate APR credit limit and monthly payments.

With revolving credit you can make a minimum payment and carry or revolve the rest of your debt from one month or billing period to the next. Corporate Finance Institute. Revolving credit is sometimes referred to as open-end credit or credit lines because you can literally access the available credit whenever you.

The 3 main types of credit are revolving credit installment and open credit. Despite an improving economy households with credit card balances owed an average 9333 in early 2018 with many living precariously close. With a home equity line of credit or HELOC a home owner can get a line of credit from the.

Revolving credit allows a borrower to spend the money they have borrowed. Find a Card With Features You Want. Borrowers generally use closed-end credit to fund expensive.

Youll be able to access funds when and where you like up to an established. Using a credit card issued by a store a bank card such as VISA or MasterCard or overdraft protection are examples of open-end credit. Credit cards are an example of revolving open-end credit.

With open-end credit you receive a credit line with a limit that you can draw from as needed only paying interest on what you borrow. Open-end credit on the other hand is revolving credit that allows you to continually access money as you make payments and only pay interest on what you use. View Test Prep - Open End Credit examples from MATH 140 at Colorado Technical University.

A line of credit or open-end credit is advantageous for many borrowers as they are able to use precisely the amount of money they need and only pay interest on what is borrowed. Advantages of Open Credit.

Revolving Credit Vs Installment Credit What S The Difference

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

What Is Open End Credit Experian

What Is A Credit Utilization Rate Experian

Revolving Credit Personal Credit Loans Lines Of Credit

:max_bytes(150000):strip_icc()/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

How Revolving Credit Works Howstuffworks

Revolving Credit Vs Line Of Credit What S The Difference

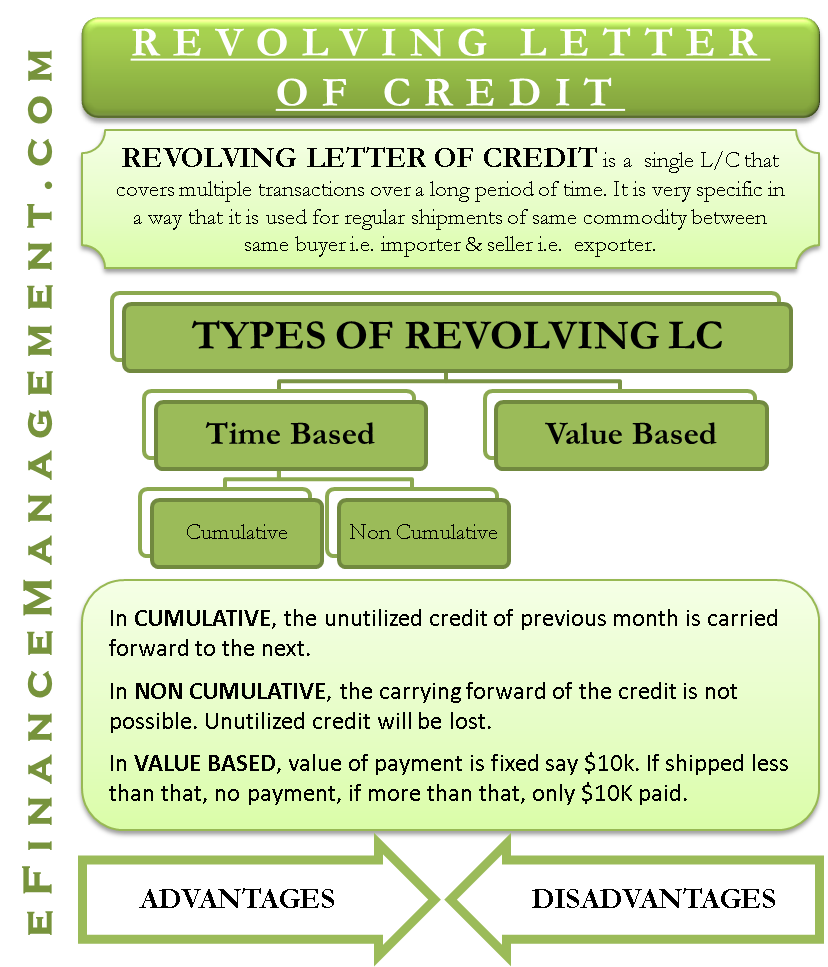

Revolving Letter Of Credit Meaning Types With Example

Open End Credit Examples Open End Credit This Is A Type Of Credit Loan Paid On Installments In Which The Total Amount Borrowed May Change Over Time Course Hero

What Is Open End Credit How It Works Examples Pros And Cons Cash 1 Blog News

The Difference Between Revolving And Nonrevolving Credit Bankrate

The Top Pros And Cons Of A Revolving Credit Line Fora Financial Blog

How Revolving Credit Works Howstuffworks

Difference Between Revolving And Non Revolving Credit Facilities

Understanding Different Types Of Credit Nextadvisor With Time

Understanding Different Types Of Credit Nextadvisor With Time